Never miss a story: Follow your cherished subjects and creators to receive a customized email with the news-casting that makes the biggest difference to you.

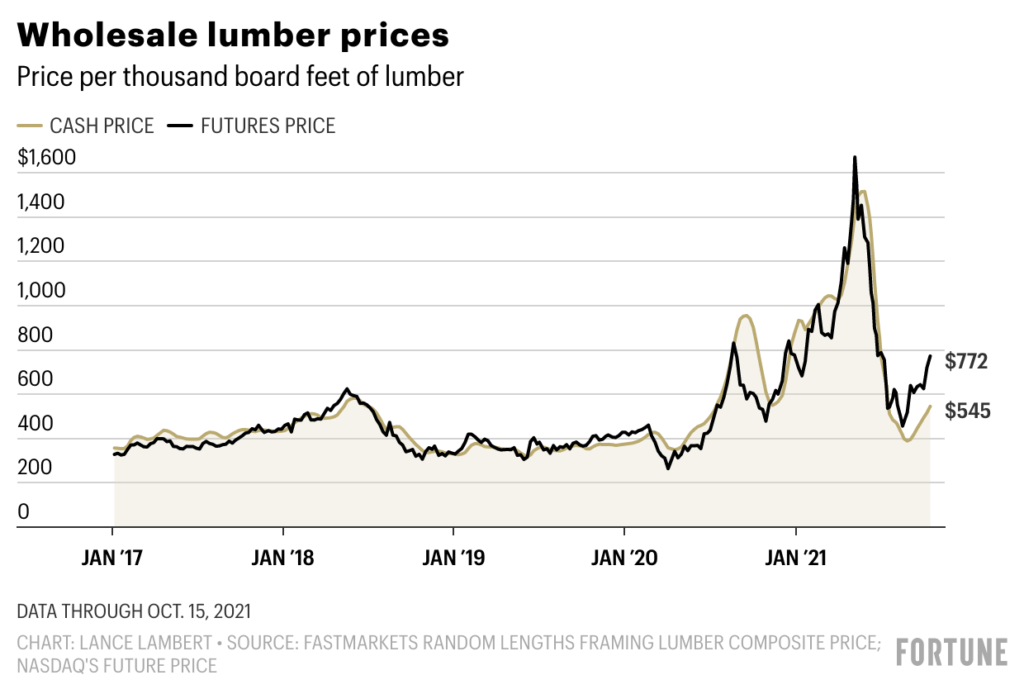

Straightforward financial matters popped the wood bubble the year before. When the cost of timber beat $1,515 per thousand board feet in the spring, do-it-yourselfers all at once quit purchasing. Simultaneously, sawmills attempting to take advantage of the high as can be costs expanded creation, adding to costs plunging by August to $389 per thousand board feet. Out of nowhere, blunder purchasers, who were accustomed to paying $350 to $500 per thousand board feet earlier the pandemic, felt some genuine help.

End of the story, isn’t that so?

Not in the least. Since lining in August, blunder has gone.on one more run that is beginning to look a ton like the noteworthy run we saw the previous spring. As of Friday, the money market cost is back up to $1,111 per thousand board feet. That is up 186% (or practically triple) over its base cost in August.

However, the elements pushing up costs are altogether different this time. During the last go around, pandemic lockdowns had restricted creation similarly as remote working set off a home remodel blast and downturn initiated low home loan rates prodded more interest for homebuilding. Rather than lockdowns, fault natural force this time. The awful out of control fire season this late spring in the U.S. Pacific Northwest and British Columbia-the focal points of North American softwood creation saw a few sawmills reduce creation. In the interim, landslides and flooding brought about by a record precipitation in November have postponed blunder shipments emerging from the Port of Vancouver. That supply decay is basically outclassed by popularity from manufacturers who are as yet selling homes quicker than they can assemble them.

As costs began to spike before the end of last year, providers and homebuilders reacted by expanding their timber orders. Stinson Dean, CEO of Deacon Lumber price, a wood exchanging organization, advises Fortune those purchasers would have rather not get found out distracted like last time so they purchased ahead “for good measure” costs moved back to the excessive degrees of spring 2021. For, that inundation of purchasers just set all the more vertical strain on costs.

“Request is remarkable. We have been immersed with work statements throughout the previous two months, and have booked record measures of future business. Purchasers would rather not get captured level footed and have the market fled from them like happened a year prior,” says Michael Goodman, head of specialty items at Sherwood Lumber.

Never miss an anecdote about land

What would be an ideal next step? Industry insiders don’t predict blunder more than $1,000 per thousand board feet as the new typical. Definitely, sawmills will pursue benefits and increment creation. In any case, it’s hard to say when costs will fall once more.

“At last the craze will die down logical later in the principal quarter or right off the bat in the subsequent quarter, and we will begin to see headwinds like higher loan fees,” Goodman says. Obviously, higher loan costs and home loan rates, which are relied upon to rise this year, could slow the real estate market and building.

In any case, don’t expect modest wood at any point in the near future. Regardless of whether wood costs pull back to some degree, it doesn’t mean we’re made a beeline for pre-pandemic levels. There is a lack of around 4 million homes-a powerful that is probable going to keep developers occupied (otherwise known as purchasing more wood) into the indefinite future.