The inventive innovation for improving and mechanizing the stock and utilization of monetary administrations is utilized to clarify monetary advancements (Fintech). Fintech is at its heart used to help firms, organization proprietors, and customers by utilizing particular programming and calculations that are being utilized on PCs and progressively cell phones for better monetary administration, methods, and ways of life. Fintech is the name for a “monetary innovation” combo.

“Fintech” alluded to the innovation utilized in back-end frameworks of set up monetary foundations when fintech was presented in the 21st century. From that point forward, in any case, a change to more shopper situated administrations has occurred, consequently making it more buyer arranged. It permits clients to get credits for monetary guides online from online locales like https://www.paydaylv.com. Fintech at present involves a few regions and organizations, for instance, instruction, retail banking, raising money, non-benefit, and venture the executives.

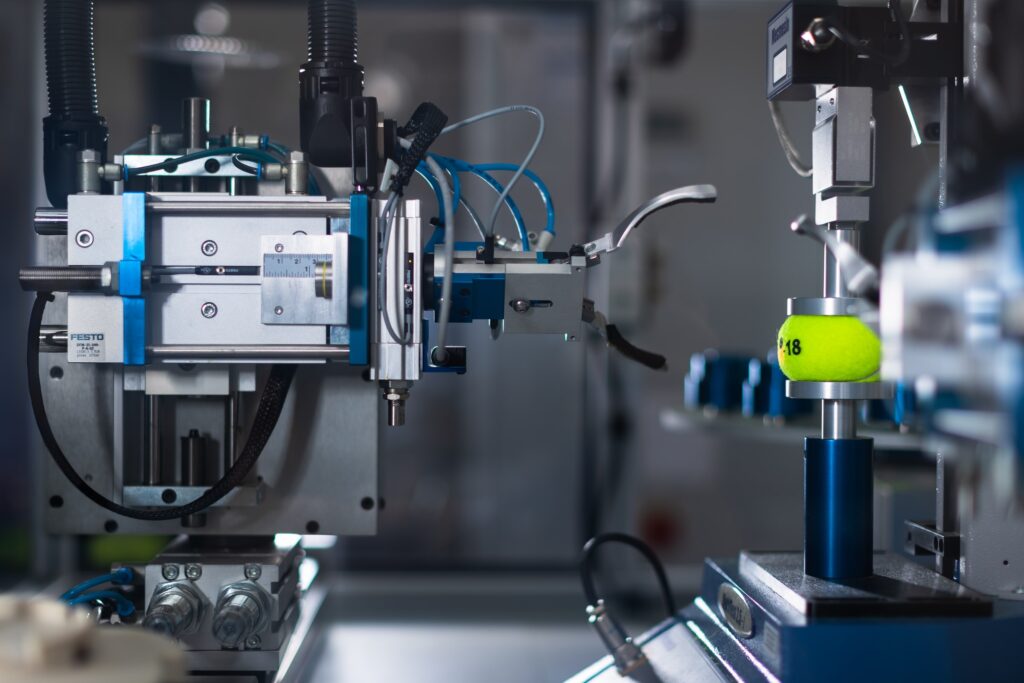

Source: Arising Europe

Substance [show]

Is FinTech what’s to come?

Administrative center help for brokers and dealers was utilized by monetary innovation. Hazard financial backers barely put resources into the business. In the area, public firms were rarely appeared differently in relation to Silicon Valley’s developing sweethearts. This has changed, however. Private danger capital has flooded all through the previous decade and Fintech’s venture dollars share has ascended from 5% to around 20%. In the advancement economy, Fintech discovers its place.

With more, increasingly more ‘fintech’ new businesses like OFX progressing up the positions and altering the manner in which the innovation is moving cash, the rate for disturbance in the monetary administrations area is at a rate never seen.

Envision an existence where monster firms rival firms with little and smooth impressions that make the client experience flawlessly including new versatile advancements to computer based intelligence. We may not be there yet, yet our future is additionally not far away. The banks will not kick the bucket. Yet, you will see firms from Fintech get a few things, like unfamiliar trade exchanges. You are seeing extraordinarily viable help organizations that take on various organizations.

Source: TechoGhetto

Fintech gives a more comprehensive future potential

This ‘decentralization’ of monetary administrations openings may build up a climate where banks and fintech new businesses might have the option to share assets all the more cooperatively and subsequently work with keeping up in the realm of quick evolving things.

Those that work at significant banks are frequently banking foundations. Nonetheless, Glen says that ‘people in these new Fintech new companies every now and again don’t come from banks, they come from outside banks and need to improve the situation for consumers.’This gives space to advancements in the bigger trade of gifts and data that a firm may purchase from various foundations when people work in a firm.

Source: Garrigues

FinTech and 2021

As individuals think back on 2021, FinTech Application Advancement Administrations is seeing new gauges which may move the monetary area to “another norm.”

In 2021, the full money installment will be re-appropriated without contact

The strategy where installments have changed quickly over the past couple of years since credit only installments have enormously surpassed cash. A couple of individuals have seen that innovative installment techniques are coordinated easily in cellphones or Web based business destinations. One noteworthy model is Uber, which permits customers to enroll their charge cards and furnishes them with fast online installment administrations to auto appointments. Prior or later, a few extra highlights will be added to these advances to guarantee that cash installments are out of date later on.

Source: OnDeck Canada

FinTech World will see Miniature Banks mushrooming

FinTech experts are affirming emphatically that the lockdown delivery and diminishes in circumstances of Coronavirus are fundamentally higher. Furthermore, the accessibility of an immunization to treat the lethal infection raises the possibility that private companies can take up their tasks all along. This will extend the quantity of miniature loaning organizations through FinTech organizations. It will squeeze organizations by giving them the best online monetary administrations to fulfill clients’ assumptions.

Accordingly for little and medium-sized firms, the loaning system is simplified. It likewise assists them with advancing quickly on their course to progress. Also, FinTech organizations will upgrade their collaboration with banks to appropriately apply for credits and installments to normal individuals.

Source: kiplinger

FinTech industry should give the idea of monetary incorporation a genuine idea

Among weak people, particularly those experiencing a genuine monetary emergency, the impacts of the Coronavirus scourge have been considerable. They are moreover searching for a significant and prompt money answer. A few extraordinary arrangements are not difficult to suit FinTech’s requirements that don’t need to concern.

To start with, there is an association card that permits clients to buy administrations for somebody. Furthermore, B4B Installments has been teaming up with Transient Assistance to guarantee that people approach ledgers utilizing pre-loaded cards. This has been helpful.

Source: business visionary

The hotly debated issue post-Coronavirus World is installed financing

However monetary administrations are quick adjusting across banks and different associations, they are as of now making a stride further to achieve a total unrest to accomplish an exact FinTech application arrangement. How does this function? The arrangement is “consolidated money,” as the fate of monetary work is imagined by a few trained professionals.

In spite of the fact that it was not acknowledged by the old financial model, arising firms, for example, Uber and Amazon have viably incorporated monetary installed installments into their administrations.

Furnishing FinTech Speculation with a safe stage will be a test

In spite of the fact that financial backers are burning through trillions of dollars on FinTech, are the security components of the business actually puzzled? For what reason does it happen? The continuous monetary vulnerability brought about by the current plague is a solid explanation. As a result, financial backers progressively rely on a set up FinTech application advancement organization for a more secure venture.

In this way, for FinTech firms, one year from now will be fundamental. This is on the grounds that they need to get ready the financial backers for a protected air as well as acquire their certainty. In any event, overseeing web installments individual to-individual will likewise be an issue.

Source: The Financial Occasions

FinTech associations (and new businesses) consequently need to foster some new ideas to develop a security methodology to guarantee that the voice, video, and visit capacities are securely utilized. Without disarray, just the financial backers will completely put resources into FinTech.